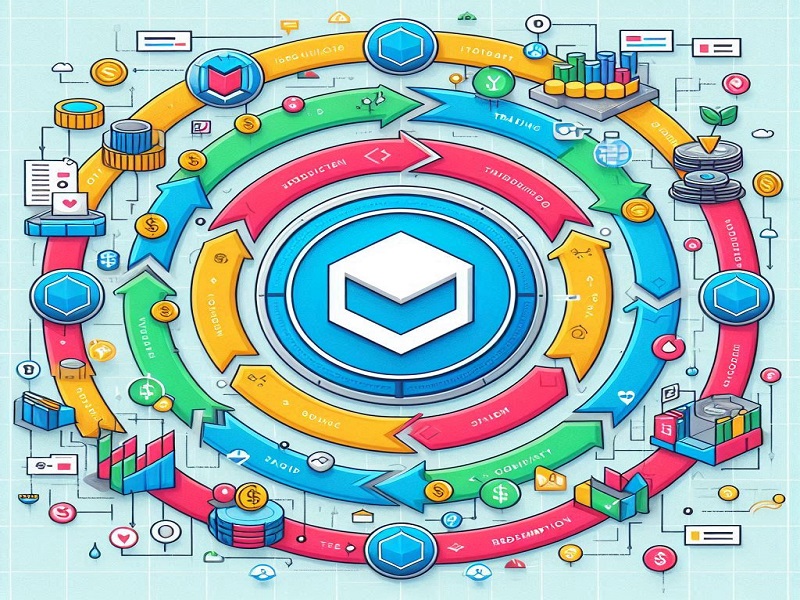

In the world of blockchain and digital assets, understanding the token lifecycle is essential. For anyone involved in crypto token development, this journey from creation to transfer—and every stage in between—defines how tokens are designed, managed, and utilized. This guide will walk you through each stage of the token lifecycle, explaining why each is crucial and how the right development choices support seamless functionality.

Introduction to the Token Lifecycle

The token lifecycle involves several key stages, from initial creation to ongoing management and eventual transfer between users. Each stage requires careful planning and execution, especially as tokens play various roles, from asset ownership to payment solutions and governance rights. Effective token lifecycle management ensures smooth operations, security, and utility across all uses.

Crypto token development companies play a significant role in creating tokens that align with their intended functions. Choosing the best crypto token development company in India or elsewhere can impact how efficiently your tokens progress through this lifecycle, addressing compliance, scalability, and ease of transfer.

Token Creation

The token lifecycle begins with creation, where a new digital asset is developed on a blockchain. Token creation involves defining the token’s properties, purpose, and compliance standards. Here are the primary elements of token creation:

-

Token Standards: The type of token (such as ERC-20, ERC-721, or BEP-20) is based on blockchain standards. These standards set the token’s functionality, compatibility, and interoperability.

-

Smart Contracts: Smart contracts are essential for token functionality, automating transactions and other actions without human intervention. Smart contracts establish rules for token transfers, issuance, and ownership.

-

Tokenomics: Tokenomics includes the economic factors of the token—such as supply, distribution model, and utility. Clear tokenomics make the token’s value and use case clear to investors and users.

Choosing a development partner well-versed in crypto token development and token lifecycle management ensures the token’s smart contracts and properties align with the project’s goals.

Token Issuance and Initial Distribution

After creation, the token enters the issuance and distribution phase, where it’s offered to the intended users. This phase is key in establishing the token’s initial value and usage. Different issuance methods exist, each catering to specific project goals:

-

Initial Coin Offering (ICO): ICOs offer tokens to early investors in exchange for funding. This approach works well for raising capital but has faced regulatory scrutiny.

-

Security Token Offering (STO): STOs are a compliant way to issue tokens as regulated securities. They provide a level of legal security, especially for asset-backed tokens, making them ideal for investors who seek stability.

-

Airdrops and Reward Programs: Some projects issue tokens through airdrops or reward programs, targeting active users and promoting adoption.

-

Private Sales and Crowdfunding: Private sales involve exclusive sales to selected investors, often at a discount. This option suits projects that want strategic investors who can support the token ecosystem.

Proper issuance requires detailed planning, as it influences token adoption and initial liquidity. An experienced crypto token development company can create a tailored issuance strategy, optimizing initial distribution based on the target audience.

Token Lifecycle Management

Once tokens are issued, lifecycle management comes into play. This ongoing phase includes updates, security, and compliance to ensure the token maintains its intended functionality and value. Key elements in token lifecycle management include:

-

Upgradability: Tokens may require updates to accommodate new features, address security issues, or comply with new regulations. Upgradable tokens, managed through proxy contracts, allow developers to make changes without disrupting token functionality.

-

Governance: Governance determines how decisions are made regarding token management. Decentralized governance, often through voting rights, allows token holders to participate in decisions, adding transparency to the process.

-

Compliance and Regulatory Adherence: Tokens must comply with regulatory standards in each jurisdiction where they are traded. Ensuring ongoing compliance prevents legal issues and promotes trust among investors and users.

-

Security Measures: Security is essential in token lifecycle management. Regular audits, vulnerability assessments, and robust smart contract coding help secure the token ecosystem against potential attacks.

Experienced token developers understand how to manage these lifecycle elements to maximize token reliability and compliance.

Token Utilization

Utilization is where tokens start fulfilling their purpose within the ecosystem. Tokens serve various functions based on the project’s goals, which may include:

-

Utility Tokens: Utility tokens give holders access to specific services or features within a blockchain ecosystem. For instance, a utility token may allow users to access premium features on a platform or participate in community decisions.

-

Security Tokens: Security tokens represent ownership or stake in an asset, making them valuable for projects tied to real estate, equities, or debt.

-

Governance Tokens: Governance tokens grant holders voting rights, enabling them to influence the project’s direction. This structure supports decentralized decision-making, often found in Decentralized Autonomous Organizations (DAOs).

-

Payment Tokens: Payment tokens function as a means of exchange, similar to traditional currency, but within the blockchain ecosystem. Payment tokens are widely used in gaming, e-commerce, and other blockchain-based platforms.

At this stage, a well-designed token will demonstrate seamless functionality, establishing trust and usability within the user base.

Token Transactions and Transfer

Token transactions are critical in the lifecycle, enabling tokens to move between users, exchanges, and wallets. The transfer process involves key elements:

-

Blockchain Protocol: The blockchain’s protocol influences how tokens are transferred. For example, Ethereum uses gas fees to power transfers, while Solana and Polygon offer lower-cost options.

-

Wallet Integration: Users rely on digital wallets to store, send, and receive tokens. Compatibility with major wallets is important for a smooth user experience.

-

Exchanges and Liquidity: For tokens with a trading function, listing on exchanges provides liquidity. Liquidity allows investors to buy, sell, or trade tokens, which is vital for projects seeking widespread adoption.

-

Security in Transfer: Transfer security is crucial, as token transfers are vulnerable to attacks. Multi-signature wallets, encryption, and other measures reduce the risk of unauthorized transfers.

Choosing the best crypto token development company in India can provide a seamless integration of these elements, ensuring the token’s transferability, security, and compatibility with the necessary infrastructure.

Token Burn and Supply Control

Some tokens incorporate burn mechanisms, reducing total supply to increase scarcity and potential value. Token burn is typically performed by sending tokens to an unspendable address. Supply control strategies include:

-

Scheduled Burns: Pre-set burning schedules help maintain scarcity and price stability, benefiting holders by potentially increasing token value over time.

-

Transaction-Based Burns: Transaction-based burns are common with tokens designed for long-term appreciation, where a percentage of each transaction is burned.

-

Manual Burns: Some projects choose to conduct manual burns based on market conditions, balancing token availability with investor demand.

Supply control through burning is a strategy used to support value appreciation and limit inflation within the token economy.

Token Retirement or Deactivation

Eventually, some tokens may need to be retired or deactivated, ending their lifecycle. This can happen if:

-

Project Goals Are Achieved: Some tokens are created for short-term projects. When the goal is reached, retiring the token makes sense.

-

Mergers or Acquisitions: If a token project merges with another or is acquired, the original token may no longer be needed.

-

Regulatory Requirements: In cases where a token becomes non-compliant, retiring the token may be necessary to avoid legal issues.

The deactivation or retirement process should follow a secure and transparent procedure, ensuring stakeholders are informed and assets are safely transferred or converted.

Choosing the Right Development Partner for Token Lifecycle Management

Given the complexities of token lifecycle management, finding the right development partner is essential. The best crypto token development company in India or any region will have experience across all lifecycle stages, from creation to retirement. Key considerations for selecting a development partner include:

-

Expertise in Multiple Blockchains: A good partner should have experience in Ethereum, Binance Smart Chain, Polygon, and other major blockchains to support versatile token creation.

-

Compliance and Security: Top companies prioritize security, regulatory compliance, and user data protection to minimize risks and enhance trust.

-

Technical Support and Upgradability: Token projects often require ongoing support. The right partner will offer support for upgrades, ensuring smooth operations throughout the token’s lifecycle.

With the right partner, projects can navigate each lifecycle stage effectively, addressing challenges proactively to achieve long-term success.

Conclusion

The token lifecycle—from creation to transfer—includes essential stages that shape a token’s effectiveness, usability, and overall impact in the blockchain space. Each stage, from defining token properties to implementing security measures and establishing utility, contributes to the token’s functionality and value. Managing these elements carefully allows projects to achieve seamless token transactions, user trust, and market adoption.

As the demand for tokenization expands across various industries, understanding lifecycle management becomes even more critical. Selecting a skilled crypto token development company, like the best crypto token development company in India, ensures each stage is professionally handled—from smart contract creation to secure transactions—optimizing the token’s journey for success in the market.

The right partner for crypto token development empowers projects to thrive across each lifecycle phase. With expertise in creating, distributing, and maintaining tokens, companies can guide projects toward building long-term value and stability. From initial creation to everyday token transactions, effective lifecycle management is key to sustaining and growing the token’s role in a dynamic digital economy.